A new analysis found that the average number of suspected digital fraud attempts on any given day between Thanksgiving and Cyber Monday (Nov. 24 and Nov. 28) was 82% higher globally than during the rest of the year (Jan. 1, 2022 to Nov. 23, 2022) and 127% greater than during the rest of the year for transactions originating in the U.S.

These findings from TransUnion are based on intelligence from billions of transactions contained in TransUnion’s TruValidate fraud analytics solution suite. The analysis determined 15% of all global e-commerce transactions reviewed between Nov. 24 and Nov. 28 were potentially fraudulent. For transactions originating from the U.S., 18% of e-commerce transactions during that period were suspected to be fraudulent.

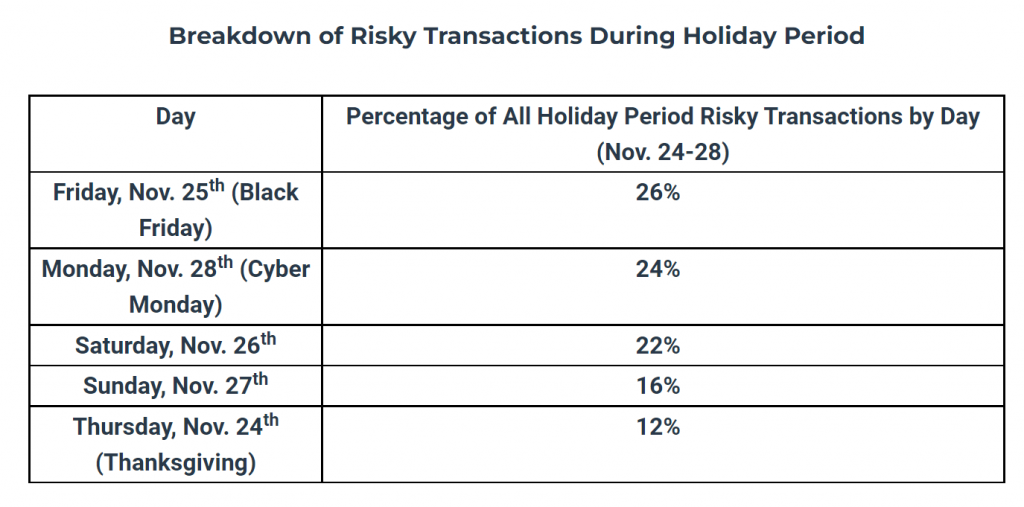

The study also revealed the share of suspected digital fraud attempts for each individual day in the holiday shopping period for transactions in the U.S. The greatest propensity of risky transactions occurred during Black Friday and Cyber Monday.

“Fraudulent activity tends to be particularly prevalent in online retail during the holiday shopping season,” said Shai Cohen, senior vice president and head of global fraud solutions at TransUnion. “Despite the fact that consumers have begun returning in larger numbers to in-person shopping in the post-pandemic era, online retail continues to be the preferred means of holiday shopping for many. It’s important that online retailers ensure consumer security and privacy protections, which is important to consumers, but in a way which ensures a seamless shopping experience that minimizes unnecessary friction.”

TransUnion also revealed in the analysis the top types of fraudulent e-commerce transactions during the holiday shopping season. This year, promotion abuse and account takeover were the leading fraud attempt types.

“Online retailers must equip themselves with the proper tools to detect fraud at the first warning sign, and without inhibiting the consumer journey,” said Cecilia Seiden, vice president of the retail business at TransUnion. “It’s more important than ever that these online retailers implement holistic fraud solutions that are able to verify customer identity and authenticity at the very beginning of a transaction without resulting in false positives that may cost them legitimate transactions.”

The increase of suspected digital fraud during the traditional busiest days of the holiday shopping season occurred as consumers express concern about being victimized. TransUnion’s 2022 Consumer Holiday Shopping Survey conducted in August 2022 found that 54% of American consumers are concerned with being victimized by online fraud this holiday season, a 17% increase from last year.

Additional information on TransUnion’s 2022 holiday fraud trends can be found here.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs

Tags: Income Taxes